ATTN: CUSTER COUNTY TAXPAYERS

SUPPLEMENTAL/REVISED REAL PROPERTY STATEMENTS HAVE BEEN MAILED PURSUANT TO MONTANA SUPREME COURT ORDER 23-0635 2023

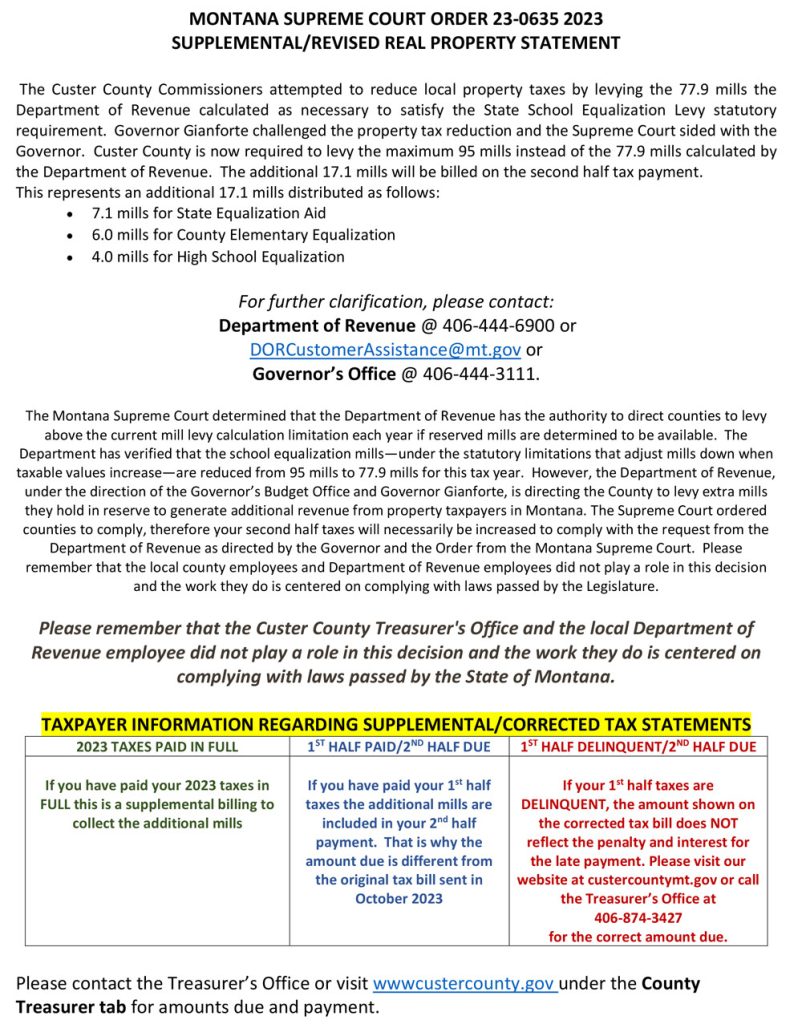

Information regarding supplemental billing:

2023 TAXES PAID IN FULL

If you have paid your 2023 taxes in FULL this is a supplemental billing to collect the additional mills.

1ST HALF PAID/2ND HALF DUE

If you have paid your 1st half taxes the additional mills are included in your 2nd half payment. That is why the amount due is different from the original tax bill sent in October 2023.

1ST HALF DELINQUENT/2ND HALF DUE

If your 1st half taxes are DELINQUENT, the amount shown on the corrected tax bill does NOT reflect the penalty and interest for the late payment. Please visit our website at custercountymt.gov or call the Treasurer’s Office at 406-874-3427 for the correct amount due. For more detailed information please see the insert included in your tax bill. If you have a mortgage company, please contact them to ensure payment has been made.

REMINDER:

REAL ESTATE TAXES ARE DUE MAY 31, 2024

Penalty and interest will be charged beginning June 1, 2024.

Download this Notice >